28 Oct Tim Cook addresses the rejection of Apply Pay by major retailers.

At The Wall Street Journal’s Global Technology Conference in Laguna Beach, California, Tim Cook pointed out (in response to the rejection of Apple Pay by major retailers) that over one million credit cards were activated within 72 hours of Apple Pay going live, making it the world’s largest point-of-sale mobile payment service.

“We’re already number one, and not just number one, but we’re more than the total of all the other guys, and we’ve only been at it a week, so I feel fantastic.” Cook stated, meaning Apple Pay is already ahead of similar systems such as Google Wallet.

A seed of paranoia with regards to the success of Apple Pay was planted when news broke that US retailers such as CVS had stopped using the smart payment technology. CVS are part of a large group of retailers including massive names such as Bed, Bath & Beyond and Walmart which are currently developing a competing system for mobile payments called CurrentC. A bit of research was all it really took to discover that in fact the two systems operate in slightly different ways with CurrentC drawing payment from the customer in a debit sort of way and working in conjunction with a rewards system which offers discounts to consumers. As a bizarre reaction to the news of Apple Pay being rejected by stores developing the CurrentC payment system, Apple users took to Apple’s App Store, where the developmental version of CurrentC is available and left negative comments alongside down ratings.

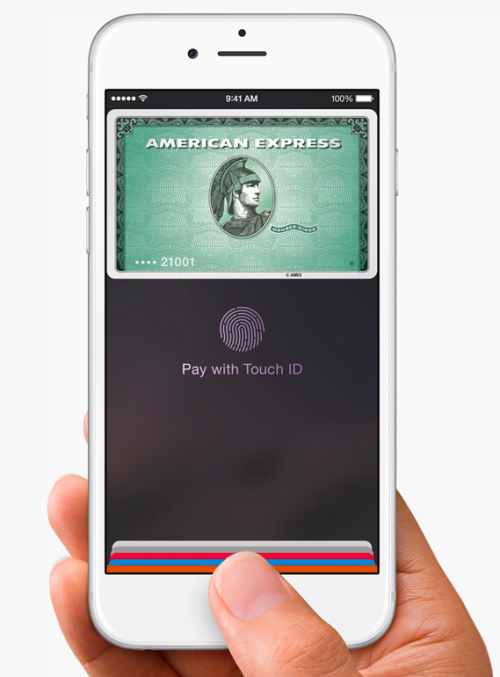

It seems, despite this week’s kerfuffle, Apple has nothing to worry about, considering 42 per cent of smart phone users in the US have iPhone handsets, Apple Pay has already reached an agreement with the top six issuers of credit cards in The United States and signed up all three major credit card networks; Visa, Mastercard and American Express.

Cook directly commented on the decision of retailers to step away from Apple Pay by saying “Over the long arc of time, retailers will step back and say, no other system is more secure”. Disabling NFC- payments does seem as inconvenient as refusing any other type of payment. If in fact, CurrentC is set to offer customer loyalty rewards then there should be no reason customers wouldn’t use both types of payment option in tandem. Much like dining in a restaurant and then discovering they don’t accept card, it’s bound to simply irritate consumers at some point down the line, but here’s where it all becomes interesting. According to Forrester Analyst, Denée Carrington, an agreement was made where the retailer group responsible for developing CurrentC – Merchants Customer Exchange – actually signed into a non-compete agreement which means even if they’d like to accent Apple Pay payments, they can’t right now.

When you consider the sheer volume of Apple devices which have just sold, all of which were enabled with Apple Pay, you might want to start reconsidering any agreement which turns that volume of potential customers away.